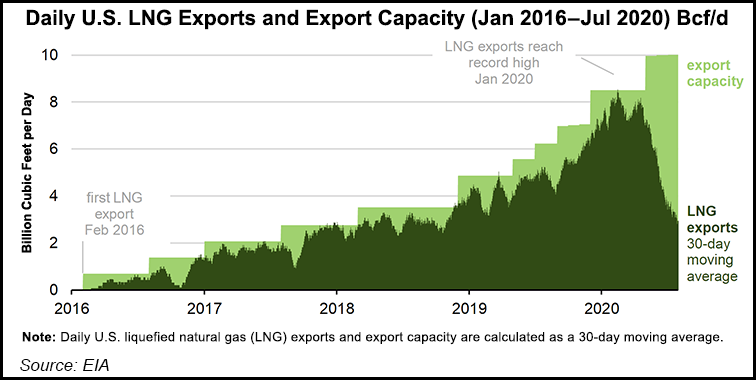

Down sharply from a peak of 8.0 Bcf/d in January, U.S. exports of liquefied natural gas (LNG) fell sharply to average just 3.1 Bcf/d in July, according to figures published Tuesday by the Energy Information Administration (EIA).

The 3.1 Bcf/d of exports averaged in July roughly matches the volume exported in May 2018, when total U.S. LNG export capacity was around one third of current capacity, the agency said.

“During the week of July 12-18, 2020, LNG weekly exports were loaded by only four vessels for a total of 2.0 Bcf/d — the same levels as the second week of December 2016,” EIA said in a research note.

EIA expects LNG exports “to remain at low levels for the next few months,” with the agency citing reports that “45 cargoes have been canceled for August shipments and an estimated 30 cargoes have been canceled for September shipments.”

The sagging export volumes have coincided with the Covid-19 pandemic that has dramatically dampened economic activity at home and abroad.

“Global natural gas demand has declined in response to Covid-19 mitigation efforts,” EIA said. “High natural gas inventories in Europe and Asia and an ongoing expansion of global LNG liquefaction capacity have also contributed to international natural gas and LNG prices reaching all-time historical lows.

“Because most U.S. LNG exports are traded in the global spot market, low global spot and forward prices for natural gas and LNG made exports from the United States uneconomical.”

Looking at the number of cargoes loaded and the total U.S. liquefaction capacity currently in operation, EIA estimates that about 46 cargoes were canceled in June and 50 were canceled in July.

Cheniere Energy Inc.’s Sabine Pass and Corpus Christi terminals, as well as the Freeport LNG terminal, were the hardest hit, operating at utilization levels of 33%, 28% and 6%, respectively, the agency said.

“Since U.S. LNG export capacity ramped up in 2018, capacity utilization in the summer has averaged more than 90% because of more weather-related LNG demand in the northern hemisphere, which consumes 98% of global LNG,” EIA said. “This summer, EIA forecasts that utilization at U.S. LNG liquefaction facilities will average 35%, or similar to utilization in off-peak months…when seasonal demand tends to be at its lowest level.”

While July’s data may look bleak for natural gas bulls, feed gas flows to U.S. LNG terminals have been more encouraging through the first third of August. NGI’s LNG Flow Tracker showed volumes climbing to 4.61 million Dth/d for Tuesday, a noticeable uptick from July levels.

Genscape Inc. similarly estimated aggregate U.S. LNG feed gas demand of 4.5 Bcf/d based on last week’s activity, the highest level recorded since late June.

Genscape analyst Josh Garcia said in a note to clients Tuesday that the higher LNG volumes have been incentivized by strengthening natural gas prices at European hubs.

The rising feed gas volumes “have been driven by Freeport LNG’s return to service after no nominations from July 7-29, and a ramp up in deliveries to Corpus Christi LNG,” Garcia said.

联系客服