涡轮增压器压缩燃烧空气(废气)并将其提供给发动机。发动机吸入的空气量相同,但是由于较高的压力,更多的空气质量被供应到燃烧室中。因此,根据速度和扫气量,将燃烧更多的燃料以增加发动机的动力输出。

关键驱动因素:

即将颁布的排放法规中排放限值的降低

对乘用车汽油发动机的需求增加

关键约束:

更高的维护成本和更多的冷却油需求

最近几年汽车产量下降

前10名玩家:

霍尼韦尔-霍尼韦尔为乘用车和商用车生产涡轮增压器。该公司服务的行业包括建筑,汽车和物流。该公司积极创新其涡轮增压器技术。例如,在2019年9月,Garrett Motion首次在IAA 2019上推出了电动涡轮增压器。电动涡轮增压器(E-Turbos)在所有燃料类型的轻型和商用车辆(如汽油,柴油,和天然气(CNG)。

大陆集团-大陆集团制造涡轮增压器;它的知名产品包括带铸钢涡轮机壳体的涡轮增压器和带铝涡轮机壳体的涡轮增压器。在2019年5月,大陆动力总成推出了环形催化剂涡轮增压器,这是适用于所有动力总成配置的解决方案,例如软件,硬件,控制单元,处理后的废气和电气化。这种新型催化剂涡轮增压器旨在减少流体动力损失并提高效率。

BorgWarner-BorgWarner经营两个业务领域:发动机和动力传动系统。这两个部门共同提供涡轮增压器,排放系统,正时装置和链条,热力系统,扭矩传递系统,旋转电气装置和传动系统。发动机领域的技术包括涡轮增压器,电子增压器,正时系统,排放系统,热力系统,汽油点火技术,机舱加热器,电池加热器和电池充电。在2019年4月,该公司通过引入13种新的涡轮增压器扩大了其涡轮增压器产品线。其售后产品组合专为轻型,重型和多功能车而设计。

三菱重工-三菱重工生产工业和基础设施业务类别下的涡轮增压器。该公司经营三个业务类别,包括电力系统,工业和基础设施,飞机以及国防和航天领域。2018年8月,三菱重工宣布了用于柴油发动机的新型小型,轻便和高效涡轮增压器。MET轴流式涡轮增压器系列主要设计用于二冲程发动机(比现有的MET-MB系列更小,更轻),其空气流量增加了16%。

IHI Corporation-IHI Corporation通过四个业务部门提供一系列产品和服务:资源,能源和环境;社会基础设施和离岸设施;工业系统和通用机械;和航空发动机;以及太空与防御。工业系统和通用机械提供与物流和机械,热处理和表面处理,农业机械和小型动力系统,运输机械,车辆涡轮增压器,钢铁制造设备和造纸机械有关的产品。

BMTS技术

ABB

电话

其他区域性参与者:

Rotomaster国际

Precision Turbo&Engine Inc.

Turbonetics Inc.

Kompressorenbau Bannewitz GmbH

涡轮动力有限公司

西莫斯

Calsonic Kansei。

汽车涡轮增压器市场的关键应用:

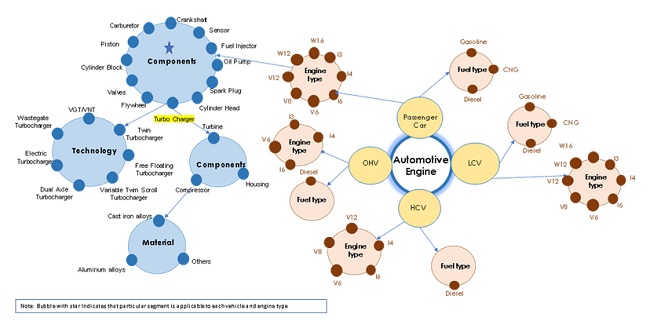

可变几何涡轮增压器(VGT / VNT)-可变几何涡轮增压器也称为可变喷嘴涡轮增压器(VNT)。在可变几何涡轮增压器中,废气的流量会根据发动机的速度和负载自动调节,这有助于减少燃油消耗。VGT技术帮助克服了固定几何涡轮增压器(FGT)/废气旁通涡轮增压器所设置的限制。可变几何形状的涡轮增压器具有不同的配置,其中包括通过涡轮后的叶片引导废气,使其比废气旁通阀更有效,更注重性能。

废气旁通涡轮增压器-废气旁通涡轮增压器是一种通过绕过涡轮增压器涡轮部分周围的排气流来控制最大增压的装置。废气旁通涡轮增压器用于防止发动机在峰值扭矩条件下发生过度增压,并在最大扭矩期间帮助打开和关闭气门。废气旁通涡轮增压器没有可动叶片,因此价格比可变几何涡轮增压器的价格低。废气旁通涡轮增压器在小型汽车中变得越来越受欢迎。

电动涡轮增压器-电动涡轮增压器是用于混合动力总成的内燃机中涡轮增压的一项先进技术。电动涡轮增压器只能在48V架构下运行。电动涡轮增压器的好处是它没有涡轮滞后。这样可以减少排放并提高燃油效率。

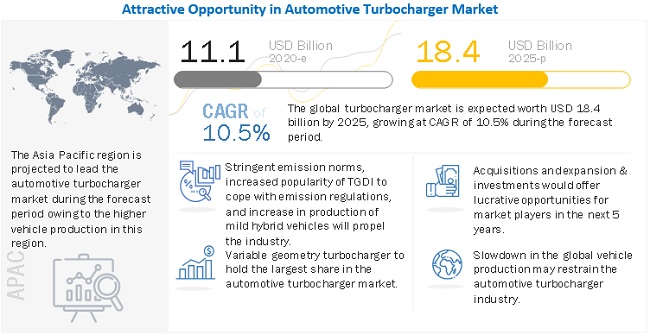

[242页报告]全球汽车涡轮增压器市场规模在2020年估计为111亿美元,预计到2020年和2025年,到2025年将达到184亿美元,复合年增长为10.5%。但是,由于COVID-19的影响,大多数国家/地区已将完全封锁时间超过了两个多月,长靴影响了汽车生产。由于对汽车生产的影响,估计COVID-19之后,汽车涡轮增压器市场将下降。COVID-19之后的全球汽车涡轮增压器市场规模预计在2020年将达到111亿美元,预计到2025年将达到184亿美元,从2020年到2025年的复合年增长率为10.5%。但是,2020年之后将稳步复苏。汽车生产的增长将在未来几年支持该市场的增长。

要了解研究考虑的假设,请索取免费样本报告

自2018年底以来,整个汽车行业仍处于极端汽车产量下降的打击,当时该行业在2019年底遭到COVID-19大流行的打击。COVID-19的影响导致制造和组装工厂的关闭,出口的中断汽车零零件。预计这种情况将影响汽车涡轮增压器市场,因为其增长与车辆的生产直接相关。预计COVID-19之前的汽车的全球产量取代2020年的约90-95百万辆增至至2025年的约110-115百万辆。虽然OICA表示,但全球汽车产量在2018-2019年期间下降了5.2%,由于OEM供应商和一些政府采取了多种措施来吸引客户,因此生产前景预计将显示2021-2022年的显着增长。

但是,由于COVID-19大流行,大多数国家将封锁完全锁定了将近两个多月,这反过来又影响了汽车的生产。根据中国汽车工业协会的统计,到2020年第一季度,乘用车产量下降了33%。欧洲的生产损失大约200万辆。根据市场和市场分析,2020年全球汽车产量将下降15%。几家大型汽车制造商已经开始生产汽车。例如,大众汽车,日产,现代和本田等中国汽车制造商已宣布重新开放其在中国的工厂。在欧洲,丰田,大众和奥迪已恢复运营。考虑到所有这些因素,我们预计全球汽车产量将以3的速度增长。从2020年到2025年,这一比例将达到3%。由于对汽车生产的影响,COVID-19之后,汽车涡轮增压器市场预计将下降。但是,2020年后汽车产量的稳步复苏将支持未来几年该市场的增长。

世界各地的各国政府都已采取了预防措施,减少了排放和对不可再生能源的依赖。涡轮增压器可显着减少车辆排放。使用涡轮增压器减少了气缸的排量,减少了相同输出所需的燃料量,从而减少了车辆的废气排放。它还可以提高燃油效率。由于这些原因,对涡轮增压器技术采用的推动增大了。

汽车行业正在见证全球增长。根据国际汽车制造商组织(OICA)的报告,全球汽车产量在2018年下降了1%,估计在2019年进一步下降。共享出行的增加,油价的增长,汽车的高价格,对推广电动汽车的尺寸压力是影响汽车行业的主要因素。反过来,这种直接影响了涡轮增压器行业。

由于消除了涡轮滞后,电动涡轮增压器可提供更大的动力和更高的燃油效率。它提供了各种好处,并且减少了技术挑战。这也导致较少的维护和冷却油需求。由于e-turbo必须提供多种好处,并且对提高燃油效率和输出功率的需求不断增长,因此在未来几年中,逐步扩大深度地渗透市场。

涡轮滞后是传统涡轮增压器的主要挑战。大多数柴油发动机都配备了传统的涡轮增压器,它们具有这种滞后性。通过使用电子涡轮增压器可以消除这一挑战。电子涡轮增压彻底消除了涡轮增压滞后,而且还提高了车辆的效率和燃油经济性。

柴油涡轮增压器市场已经成熟,因为所有商用车大部分都是柴油驱动的,并且几乎所有汽车都配备了涡轮增压器。因此,对汽油涡轮增压器的需求正在快速增长。TGDI在汽油车中的采用增加了汽油涡轮增压器的市场,严格的排放标准将进一步推动市场。随着排放法规越来越严格,OEM厂商也正在转向天然气或替代燃料汽车,甚至在重型商用车中也是如此。虽然这些这些代用燃料汽车的传播受到限制,但是与传统燃料分类,或者燃油效率更高,能源更清洁,成本降低等优点正好在不久的将来推动这些车辆的需求。这也将改变涡轮提升器的需求。

涡轮增压器在某种工程车辆和农用拖拉机的非公路车辆中发现必不可少的应用。根据行业专家的说法,低马力拖拉机没有安装涡轮增压器,而几乎所有高马力拖拉机通常都配备了涡轮增压器。另外,预计几乎所有建筑设备都将配备涡轮增压器。由于OHV设备的电气化至少在接下来的4 - 5年内受到限制,因此在不久的将来不太可能影响对OHV涡轮增压器的需求。建筑设备市场已出现增长,尤其是在中国和印度等新兴经济体中。

涡轮增压器的设计通常使其使用寿命与发动机一样长。它不需要任何特殊维护,并且检查仅限于几次定期检查。当发动机以2000至6000的转速运转时,涡轮增压器以150000 RPM的速度运转。但是,诸如热裂纹,涡轮组件的氧化/生锈以及旋转部件的金属疲劳之类的因素可能会损坏涡轮增压器,从而可能导致更换涡轮增压器。考虑到HCV行驶的里程增加,这些车辆中涡轮增压器的更换率非常高。HCV在不同地区的平均行驶里程为每年29000英里至30,500英里。因此,据估计,HCV引领了涡轮增压器的售后市场需求。

要了解研究考虑的假设,请下载pdf手册

考虑到中国工厂的开业,我们预计从2020年到2025年,全球汽车产量将以3.3%的速度增长。COV-19大流行导致汽车产量下降。但是,亚太地区仍然是全球最大的汽车生产国。在所有领先的汽车制造商中都有重要的业务,亚洲大洋洲是世界上最大的乘用车生产商。亚洲大洋洲的主要汽车生产国是中国,日本,印度和韩国。由于该地区实施了严格的排放标准,因此亚洲大洋洲估计是最大的汽车涡轮增压器市场。IHI,德国大陆集团,三菱重工,博格华纳等主要参与者的存在扩大了该地区涡轮增压器的范围。到2024年,中国的乘用车产量估计将超过2000万,其中50%已经配备TGDI,现在将扩大涡轮增压器市场。其他新兴经济体则对轻型混合动力汽车等清洁汽车施加压力,严格的排放标准将在未来对涡轮提升器行业产生积极影响。

汽车涡轮增压器市场由霍尼韦尔(美国),博格华纳(美国),三菱重工(日本),IHI(日本)和大陆集团(德国),博世马勒(德国),康明斯(美国) ,ABB(瑞士),TEL(印度)和Delphi Technologies(英国),Rotomaster International(加拿大),Precision Turbo&Engine INC(美国),Turbonetics(美国),Turbo International(美国),Kompressorenabu Bannewitz GMBH(德国),Turbo Dynamic Ltd.(英国),富源涡轮增压器有限公司(中国),湖南泰恩机械有限公司(中国),宁波汽车工业有限公司(中国),Calsonic Kansei(日本)。

报告指标 | 细节 |

多年可用的市场规模 | 2018–2025 |

考虑的基准年 | 2019年 |

预测期 | 2020–2025 |

预测单位 | 价值(百万美元/十亿)和销量('000 /百万个单位)(用于汽车行业) |

涵盖的细分 | 技术,材料,燃料类型,公路和非公路车辆,售后市场和地区 |

覆盖的地域 | 亚洲大洋洲,欧洲,北美和RoW |

公司覆盖 | 霍尼韦尔(美国),博格华纳(美国),三菱重工(日本),IHI(日本)和大陆集团(德国),博世马勒(德国),康明斯(美国),ABB(瑞士),TEL (印度)和德尔福技术公司(英国),Rotomaster International(加拿大),Precision Turbo&Engine INC(美国),Turbonetics(美国),Turbo International(美国),Kompressorenabu Bannewitz GMBH(德国),Turbo Dynamic Ltd.(英国), (中国),湖南泰恩机械有限公司(中国),宁波汽车工业有限公司(中国),Calsonic Kansei(日本)。 |

VNT / VGT

废气门

电动的

双涡轮增压

自由浮动

双轴

铸铁

铝

其他

涡轮

压缩机

住房

柴油机

汽油

农用拖拉机

建筑设备

乘用车

轻型商用车

卡车

总线

压缩天然气/替代燃料

乘用车

轻型车辆

重型车辆

北美

欧洲

亚太地区

世界其他地区

2019年5月:美国大陆航空宣布其动力总成业务成为独立实体,以“ Vitesco Technologies”的名义进行交易。该公司将以新的伞形品牌大陆集团的形式作为三个公司的控股公司进行管理:橡胶,汽车和动力总成。

2019年5月:大陆动力总成推出了环形催化剂涡轮增压器,这是适用于所有动力总成配置的解决方案,例如软件,硬件,控制单元,处理后的废气和电气化。这种新型催化剂涡轮增压器旨在减少流体动力损失并提高效率。

2019年4月:博格华纳推出13种新的涡轮增压器,扩大了其涡轮增压器产品线。其售后产品组合专为轻型,重型和多功能车而设计。

COVID-19对汽车涡轮增压器市场的影响?

汽车涡轮增压器制造商采取了哪些策略来克服COVID-19的影响?

有哪些主要市场趋势会影响汽车涡轮增压器市场的增长?

亚太地区废气门涡轮增压器的市场预期及其需求如何?

汽车涡轮增压器市场供应商面临哪些机遇和挑战?

要与我们的分析师讨论上述发现,请单击“与分析师对话”。

目录

1简介(第-33页)

1.1目标

1.2市场定义

1.3包含与排除

1.4市场范围

图1市场细分:汽车涡轮增压器市场

1.5局限性

1.6利益相关者

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE TURBOCHARGER MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources referred for vehicle production

2.1.1.2 Key secondary sources referred for market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Sampling techniques & data collection methods

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH: AUTOMOTIVE TURBOCHARGER MARKET

FIGURE 5 APPROACH 1 - BOTTOM-UP APPROACH: AUTOMOTIVE TURBOCHARGER MARKET

2.2.2 BOTTOM-UP APPROACH: OFF-HIGHWAY TURBOCHARGER MARKET

FIGURE 6 BOTTOM-UP APPROACH: OFF-HIGHWAY TURBOCHARGER MARKET

2.2.3 APPROACH 2: TOP-DOWN APPROACH: AUTOMOTIVE TURBOCHARGER MATERIAL MARKET

FIGURE 7 TOP-DOWN APPROACH: AUTOMOTIVE TURBOCHARGER MATERIAL MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 PRE- & POST-COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: AUTOMOTIVE TURBOCHARGER MARKET, 2018–2025 (USD MILLION)

FIGURE 10 AUTOMOTIVE TURBOCHARGER: MARKET OUTLOOK

FIGURE 11 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

FIGURE 12 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2020 VS. 2022 VS. 2025 (USD MILLION)

4 AUTOMOTIVE TURBOCHARGER MARKET, PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE TURBOCHARGER MARKET

FIGURE 13 STRINGENT EMISSION AND FUEL ECONOMY REGULATIONS TO DRIVE THE AUTOMOTIVE TURBOCHARGER MARKET

4.2 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY

FIGURE 14 VARIABLE GEOMETRY TURBOCHARGER TO HOLD THE LARGEST SHARE IN 2020, BY VALUE (USD MILLION)

4.3 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE

FIGURE 15 GASOLINE TURBOCHARGERS TO OVERTAKE DIESEL TURBOCHARGERS, BY VALUE (USD MILLION)

4.4 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE

FIGURE 16 PASSENGER CAR TO BE THE LARGEST AND FASTEST GROWING SEGMENT, BY VALUE (USD MILLION)

4.5 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL

FIGURE 17 CAST IRON SEGMENT TO HOLD THE LARGEST SHARE IN 2020, BY VOLUME (’000 TONS)

4.6 AUTOMOTIVE TURBOCHARGER MARKET, BY OFF-HIGHWAY VEHICLES

FIGURE 18 AGRICULTURAL TRACTOR TO BE THE LARGEST OFF-HIGHWAY VEHICLE SEGMENT, BY VALUE (USD MILLION)

4.7 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO DOMINATE DURING THE FORECAST PERIOD

4.8 AUTOMOTIVE TURBOCHARGER AFTERMARKET

FIGURE 20 ASIA PACIFIC TO BE THE LARGEST AFTERMARKET FOR TURBOCHARGERS, BY VALUE (USD MILLION)

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 YEARS CONSIDERED FOR THE STUDY

5.3 CURRENCY AND PRICING

TABLE 1 CURRENCY EXCHANGE RATES (WRT PER USD)

5.4 MARKET DYNAMICS

FIGURE 21 AUTOMOTIVE TURBOCHARGER: MARKET DYNAMICS

5.4.1 DRIVERS

5.4.1.1 Decrease in emission limits in upcoming emission regulations

TABLE 2 OVERVIEW OF EMISSION REGULATION SPECIFICATIONS FOR PASSENGER CARS, 2016–2021

TABLE 3 EMISSION NORMS IN KEY COUNTRIES FOR PASSENGER CARS

FIGURE 22 EMISSION LIMITS CHANGE IN EUROPE

FIGURE 23 EMISSION LIMITS CHANGE IN CHINA – CHINA V VS CHINA VI

5.4.1.2 Increased demand for passenger car gasoline engines

FIGURE 24 TREND OF GASOLINE PASSENGER CARS IN EUROPE, 2017-2020 (UNITS)

5.4.2 RESTRAINTS

5.4.2.1 Higher maintenance cost and more cooling oil requirements

5.4.2.2 Decrease in vehicle production in the last few years

FIGURE 25 GLOBAL PASSENGER CAR PRODUCTION, 2017-2019 (MILLION UNITS)

FIGURE 26 GLOBAL ELECTRIC VEHICLE SALES, 2017 VS 2025

5.4.3 OPPORTUNITIES

5.4.3.1 Electric turbochargers will give a boost to the future demand for turbochargers

5.4.4 CHALLENGES

5.4.4.1 Turbo lag

5.4.4.2 Durable, temperature resistant, economical materials for turbochargers

5.5 REVENUE SHIFT FOR THE TURBOCHARGER MANUFACTURERS

FIGURE 27 UPCOMING EMISSION REGULATIONS TO SHIFT THE FOCUS TOWARDS TURBOCHARGED GASOLINE ENGINES AND ELECTRIC PROPULSION

6 COVID-19 IMPACT ANALYSIS (Page No. - 66)

6.1 COVID-19 IMPACT ANALYSIS ON AUTOMOTIVE MARKET

TABLE 4 EUROPE: LOSS IN VEHICLE PRODUCTION DUE TO PLANT SHUTDOWNS, BY COUNTRY, (UNITS)

FIGURE 28 AUTOMOTIVE PRODUCTION: PRE- VS. POST-COVID-19 SCENARIO, 2018–2025 ('000 UNITS)

TABLE 5 AUTOMOTIVE PRODUCTION: PRE- VS. POST-COVID-19 SCENARIO, 2018–2025 ('000 UNITS)

6.2 COVID-19 IMPACT ANALYSIS ON TURBOCHARGER MARKET

6.2.1 AUTOMOTIVE TURBOCHARGER MARKET SCENARIO

FIGURE 29 AUTOMOTIVE TURBOCHARGER MARKET SCENARIO 2018-2025 (USD MILLION)

6.2.1.1 Realistic scenario

TABLE 6 AUTOMOTIVE TURBOCHARGER MARKET (REALISTIC SCENARIO), BY REGION, 2018–2025 (MILLION USD)

6.2.1.2 High COVID-19 impact scenario

TABLE 7 AUTOMOTIVE TURBOCHARGER MARKET (HIGH COVID-19 IMPACT SCENARIO), BY REGION, 2018–2025 (MILLION USD)

6.2.1.3 Low COVID-19 impact scenario

TABLE 8 AUTOMOTIVE TURBOCHARGER MARKET (LOW COVID-19 IMPACT SCENARIO), BY REGION, 2018–2025 (MILLION USD)

7 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE (Page No. - 71)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

7.1.4 GLOBAL VEHICLE PRODUCTION DATA

TABLE 9 GLOBAL VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 (’000 UNITS)

FIGURE 30 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020 VS 2025 (USD MILLION)

TABLE 10 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (’000 UNITS)

TABLE 11 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (’000 UNITS)

TABLE 12 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 13 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

7.2 PASSENGER CARS

7.2.1 INCREASING PASSENGER CAR PRODUCTION WILL BOOST THE TURBOCHARGER MARKET IN ASIA PACIFIC AND EUROPE

TABLE 14 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2017–2019 (’000 UNITS)

TABLE 15 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2020–2025 (’000 UNITS)

TABLE 16 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 17 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 LIGHT COMMERCIAL VEHICLES

7.3.1 INCREASING TREND OF TURBOCHARGER APPLICATION IN LCV WILL BOOST THE GROWTH OF THE NORTH AMERICA MARKET

TABLE 18 LIGHT COMMERCIAL VEHICLES TURBOCHARGER MARKET, BY REGION, 2017–2019 (’000 UNITS)

TABLE 19 LIGHT COMMERCIAL VEHICLES TURBOCHARGER MARKET, BY REGION, 2020–2025 (’000 UNITS)

TABLE 20 LIGHT COMMERCIAL VEHICLES TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 21 LIGHT COMMERCIAL VEHICLES TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

7.4 TRUCK

7.4.1 GROWTH IN CONSTRUCTION, INFRASTRUCTURE & TRANSPORTATION SECTORS TO DRIVE THE AUTOMOTIVE TURBOCHARGER DEMAND

TABLE 22 TRUCK TURBOCHARGER MARKET, BY REGION, 2017-2019 (’000 UNITS)

TABLE 23 TRUCK TURBOCHARGER MARKET, BY REGION, 2020-2025 (’000 UNITS)

TABLE 24 TRUCK TURBOCHARGER MARKET, BY REGION, 2017-2019 (USD MILLION)

TABLE 25 TRUCK TURBOCHARGER MARKET, BY REGION, 2020-2025 (USD MILLION)

7.5 BUS

7.5.1 INCREASING DEMAND FOR PUBLIC AND PRIVATE TRANSPORTATION TO BOOST THE MARKET FOR BUSES IN ASIA

TABLE 26 BUS TURBOCHARGER MARKET, BY REGION, 2017–2019 (’000 UNITS)

TABLE 27 BUS TURBOCHARGER MARKET, BY REGION, 2020–2025 (’000 UNITS)

TABLE 28 BUS TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 29 BUS TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

8 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE (Page No. - 82)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 31 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2020 VS 2025 (USD MILLION)

TABLE 30 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2017–2019 ('000 UNITS)

TABLE 31 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2020–2025 ('000 UNITS)

TABLE 32 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2017–2019 (USD MILLION)

TABLE 33 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2020–2025 (USD MILLION)

8.2 DIESEL

8.2.1 INCREASING STRINGENT EMISSION NORMS WILL IMPACT THE AUTOMOTIVE TURBOCHARGER MARKET

TABLE 34 DIESEL USAGE IN PASSENGER CARS, BY REGION, 2018 VS 2022 VS 2025 (%)

TABLE 35 DIESEL TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 36 DIESEL TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 37 DIESEL TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 DIESEL TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 GASOLINE

8.3.1 INCREASING DEMAND FROM EUROPE WILL DRIVE THE MARKET FOR GASOLINE VEHICLES

TABLE 39 GASOLINE USAGE IN PASSENGER CARS, BY REGION, 2018 VS 2022 VS 2025 (%)

TABLE 40 GASOLINE TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 41 GASOLINE TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 42 GASOLINE TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 GASOLINE TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

8.4 ALTERNATE FUEL/CNG

8.4.1 SUBSIDIZED PRICE AND ENVIRONMENTAL BENEFITS WILL HELP CNG VEHICLES TO GROW

TABLE 44 CNG USAGE IN PASSENGER CARS, BY REGION, 2018 VS 2022 VS 2025 (%)

TABLE 45 ALTERNATE FUEL/CNG TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 46 ALTERNATE FUEL/CNG TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 47 ALTERNATE FUEL/CNG TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 ALTERNATE FUEL/CNG TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

9 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY (Page No. - 91)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 32 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY, 2020 VS 2025 (USD MILLION)

TABLE 49 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY TYPE, 2017–2019 (’000 UNITS)

TABLE 50 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY TYPE, 2020–2025 (’000 UNITS)

TABLE 51 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY TYPE, 2017–2019 (USD MILLION)

TABLE 52 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY TYPE, 2020–2025 (USD MILLION)

9.2 VARIABLE GEOMETRY TURBOCHARGER (VGT/VNT)

9.2.1 DEMAND FOR HIGH EFFICIENCY AND LOW CARBON EMISSION TECHNOLOGY WILL DRIVE THE VARIABLE GEOMETRY TURBOCHARGER MARKET

TABLE 53 VGT MARKET, BY REGION, 2017–2019 (’000 UNITS)

TABLE 54 VGT MARKET, BY REGION, 2020–2025 (’000 UNITS)

TABLE 55 VGT MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 VGT MARKET, BY REGION, 2020–2025 (USD MILLION)

9.3 WASTEGATE TURBOCHARGER

9.3.1 INCREASING DEMAND FOR SMALL CARS IN ASIA PACIFIC WILL DRIVE THE WASTEGATE TURBOCHARGER MARKET

TABLE 57 WASTEGATE TURBOCHARGER MARKET, BY REGION, 2017–2019 (’000 UNITS)

TABLE 58 WASTEGATE TURBOCHARGER MARKET, BY REGION, 2020–2025 (’000 UNITS)

TABLE 59 WASTEGATE TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 WASTEGATE TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

9.4 ELECTRIC TURBOCHARGER

9.4.1 USE OF 48V ARCHITECTURE IN FUTURE CARS AND PLUG-IN HYBRID WILL DRIVE THE ELECTRIC TURBOCHARGER MARKET

TABLE 61 ELECTRIC TURBOCHARGER MARKET, BY REGION, 2017-2019 (’000 UNITS)

TABLE 62 ELECTRIC TURBOCHARGER MARKET, BY REGION, 2020-2025 (’000 UNITS)

TABLE 63 ELECTRIC TURBOCHARGER MARKET, BY REGION, 2017-2019 (USD MILLION)

TABLE 64 ELECTRIC TURBOCHARGER MARKET, BY REGION, 2020-2025 (USD MILLION)

9.5 VARIABLE TWIN SCROLL TURBOCHARGER

9.6 TWIN TURBOCHARGER

9.6.1 TWO STAGE SERIES TURBOCHARGER

9.6.2 TWO STAGE PARALLEL TURBOCHARGER

9.6.3 TWIN SCROLL TURBOCHARGER

9.7 FREE-FLOATING TURBOCHARGER

9.8 DOUBLE AXLE TURBOCHARGER

10 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL (Page No. - 102)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 33 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2020 VS 2025 ('000 TONS)

TABLE 65 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2017–2019 ('000 TONS)

TABLE 66 AUTOMOTIVE TURBOCHARGER MATERIAL MARKET, BY VEHICLE TYPE, 2017–2019 ('000 TONS)

TABLE 67 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2020–2025 ('000 TONS)

TABLE 68 AUTOMOTIVE TURBOCHARGER MATERIAL MARKET, BY VEHICLE TYPE, 2020–2025 ('000 TONS)

10.2 CAST IRON

10.2.1 DEMAND FOR COST EFFECTIVE AND HEAT RESISTANT MATERIAL WILL HELP THE CAST IRON MARKET TO GROW

TABLE 69 CAST IRON MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2017–2019 ('000 TONS)

TABLE 70 CAST IRON MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2020–2025 ('000 TONS)

10.3 ALUMINUM

10.3.1 USE OF ALUMINUM TURBINE HOUSING IN LDV WILL INCREASE IN FUTURE

TABLE 71 ALUMINUM MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2017–2019 ('000 TONS)

TABLE 72 ALUMINUM MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2020–2025 ('000 TONS)

10.4 OTHER MATERIALS

10.4.1 USE OF OTHER MATERIALS IN PERFORMANCE CARS WILL DRIVE THE TURBOCHARGER MARKET

TABLE 73 OTHER MATERIALS MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2017–2019 ('000 TONS)

TABLE 74 OTHER MATERIALS MARKET FOR TURBOCHARGERS, BY VEHICLE TYPE, 2020–2025 ('000 TONS)

11 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT (Page No. - 109)

11.1 INTRODUCTION

11.1.1 INDUSTRY INSIGHTS

11.2 TURBINE

11.3 COMPRESSOR

11.4 HOUSING

12 OFF-HIGHWAY TURBOCHARGER MARKET, BY INDUSTRY (Page No. - 111)

12.1 INTRODUCTION

FIGURE 34 NRMM UPCOMING VS SPECULATED EMISSION REGULATIONS, 2019-2030

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 35 OFF-HIGHWAY VEHICLE TURBOCHARGER MARKET, BY INDUSTRY, 2020 VS 2025 (USD MILLION)

TABLE 75 OFF-HIGHWAY TURBOCHARGER MARKET, BY INDUSTRY, 2017–2019 ('000 UNITS)

TABLE 76 OFF-HIGHWAY TURBOCHARGER MARKET, BY INDUSTRY, 2020–2025 ('000 UNITS)

TABLE 77 OFF-HIGHWAY VEHICLE TURBOCHARGER MARKET, BY INDUSTRY, 2017–2019 (USD MILLION)

TABLE 78 OFF-HIGHWAY VEHICLE TURBOCHARGER MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

12.2 AGRICULTURE TRACTOR

12.2.1 INCREASING DEMAND FOR HIGH PERFORMANCE POWER TRACTOR WILL DRIVE THE DEMAND FOR AUTOMOTIVE TURBOCHARGER

TABLE 79 AGRICULTURE TRACTOR TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 80 AGRICULTURE TRACTOR TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 81 AGRICULTURE TRACTOR TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 82 AGRICULTURE TRACTOR TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

12.3 CONSTRUCTION EQUIPMENT

12.3.1 GROWTH IN CONSTRUCTION & INFRASTRUCTURE ACTIVITIES IN ASIA PACIFIC AND NORTH AMERICA WILL DRIVE THE MARKET

TABLE 83 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 84 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 85 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 86 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

13 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE (Page No. - 120)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 36 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY REGION, 2019 VS 2025 (USD MILLION)

TABLE 87 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 88 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY REGION, 2017–2025 ('000 UNITS)

TABLE 89 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 90 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY REGION, 2020–2025 (USD MILLION)

13.2 LIGHT COMMERCIAL VEHICLE (LCV)

13.2.1 INCREASING ADOPTION OF TURBOCHARGER FOR LCV IN NORTH AMERICA WILL BOOST THE DEMAND IN FUTURE

TABLE 91 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 92 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 93 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 94 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2020–2025 (USD MILLION)

13.3 HEAVY COMMERCIAL VEHICLE (HCV)

13.3.1 HCV WILL LEAD THE MARKET, DUE TO THE HIGH MILES DRIVEN COMPARE WITH THE LCV’S

TABLE 95 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2017–2025 ('000 UNITS)

TABLE 96 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 97 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 98 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2020–2025 (USD MILLION)

14 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION (Page No. - 128)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 37 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 99 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2017–2019 ('000 UNITS)

TABLE 100 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2020–2025 ('000 UNITS)

TABLE 101 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 102 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2020–2025 (USD MILLION)

14.2 ASIA PACIFIC

14.2.1 ASIA PACIFIC VEHICLE PRODUCTION DATA

TABLE 103 ASIA PACIFIC: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

FIGURE 38 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC TURBOCHARGER MARKET, BY COUNTRY, 2017–2019 ('000 UNITS)

TABLE 105 ASIA PACIFIC TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 ('000 UNITS)

TABLE 106 ASIA PACIFIC TURBOCHARGER MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.2.2 CHINA

14.2.2.1 China vehicle production data

TABLE 108 CHINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.2.2 Emission norms, popularity of TGDI will drive the market

TABLE 109 CHINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 110 CHINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 111 CHINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 112 CHINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.3 INDIA

14.2.3.1 India vehicle production data

TABLE 113 INDIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.3.2 Increase in gasoline vehicles will drive the market

TABLE 114 INDIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 115 INDIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 116 INDIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 117 INDIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.4 JAPAN

14.2.4.1 Increasing use of TGDI engine will drive the market

TABLE 118 JAPAN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.4.2 Increased production of HEV will drive the market

TABLE 119 JAPAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 120 JAPAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 121 JAPAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 122 JAPAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.5 SOUTH KOREA

14.2.5.1 South Korea vehicle production data

TABLE 123 SOUTH KOREA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.5.2 Emission norms, shift towards gasoline will drive the market

TABLE 124 SOUTH KOREA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 125 SOUTH KOREA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 126 SOUTH KOREA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 127 SOUTH KOREA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.6 THAILAND

14.2.6.1 Thailand vehicle production data

TABLE 128 THAILAND: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.6.2 Stringent emission norms to drive the market

TABLE 129 THAILAND TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 130 THAILAND TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 131 THAILAND TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 132 THAILAND TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.7 INDONESIA

14.2.7.1 Indonesia vehicle production data

TABLE 133 INDONESIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.7.2 Availability of high-quality gasoline, government incentives to promote clean transportation will drive the market

TABLE 134 INDONESIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 135 INDONESIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 136 INDONESIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 137 INDONESIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.8 REST OF ASIA PACIFIC

14.2.8.1 Rest of Asia Pacific vehicle production data

TABLE 138 REST OF ASIA PACIFIC: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.2.8.2 Stringent emission norms, growing economy will drive the market

TABLE 139 REST OF ASIA PACIFIC TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 140 REST OF ASIA PACIFIC TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 141 REST OF ASIA PACIFIC TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3 EUROPE

14.3.1 EUROPE VEHICLE PRODUCTION DATA

TABLE 143 EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

FIGURE 39 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET SNAPSHOT

TABLE 144 EUROPE TURBOCHARGER MARKET, BY COUNTRY, 2017–2019 ('000 UNITS)

TABLE 145 EUROPE TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 ('000 UNITS)

TABLE 146 EUROPE TURBOCHARGER MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 147 EUROPE TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.3.2 GERMANY

14.3.2.1 Germany vehicle production data

TABLE 148 GERMANY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.2.2 Emission norms, shift toward gasoline vehicles will drive the market

TABLE 149 GERMANY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 150 GERMANY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 151 GERMANY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 152 GERMANY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.3 FRANCE

14.3.3.1 France vehicle production data

TABLE 153 FRANCE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.3.2 Production of mild hybrid vehicles, ban on diesel vehicles will drive the market

TABLE 154 FRANCE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 155 FRANCE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020-2025('000 UNITS)

TABLE 156 FRANCE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 157 FRANCE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

14.3.4 UK

14.3.4.1 UK vehicle production data

TABLE 158 UK: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.4.2 Lenient gasoline emission norms will drive the market

TABLE 159 UK TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 160 UK TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 161 UK TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 162 UK TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Spain vehicle production data

TABLE 163 SPAIN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.5.2 Increased sales of gasoline vehicles will drive the market

TABLE 164 SPAIN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 165 SPAIN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 166 SPAIN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 167 SPAIN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.6 ITALY

14.3.6.1 Italy vehicle production data

TABLE 168 ITALY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.6.2 Government subsidies, mild hybrid vehicles will drive the market

TABLE 169 ITALY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 170 ITALY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 171 ITALY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 172 ITALY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.7 RUSSIA

14.3.7.1 Russia vehicle production data

TABLE 173 RUSSIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.7.2 Stringent emission norms, popularity of NGV will drive the market

TABLE 174 RUSSIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 175 RUSSIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 176 RUSSIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 177 RUSSIA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.8 TURKEY

14.3.8.1 Turkey vehicle production data

TABLE 178 TURKEY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.8.2 Reduced emission limits for diesel vehicles will drive the market

TABLE 179 TURKEY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 180 TURKEY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 181 TURKEY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 182 TURKEY TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.9 POLAND

14.3.9.1 Growing production of heavy duty vehicles, presence of key players will drive the market

14.3.10 SLOVAKIA

14.3.10.1 Stringent emission norms, increased production of passenger cars will drive the market

14.3.11 REST OF EUROPE

14.3.11.1 Rest of Europe vehicle production data

TABLE 183 REST OF EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.3.11.2 Stringent emission norms, growing economy will drive the market

TABLE 184 REST OF EUROPE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 185 REST OF EUROPE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 186 REST OF EUROPE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 187 REST OF EUROPE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4 NORTH AMERICA

14.4.1 NORTH AMERICA VEHICLE PRODUCTION DATA

TABLE 188 NORTH AMERICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 189 NORTH AMERICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 190 NORTH AMERICA TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 ('000 UNITS)

TABLE 191 NORTH AMERICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 192 NORTH AMERICA TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.4.2 US

14.4.2.1 US vehicle production data

TABLE 193 US: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.4.2.2 Increasing adaption of TGDI engine and, stringent emission norms will drive the market

TABLE 194 US TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 195 US TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 196 US TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 197 US TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4.3 CANADA

14.4.3.1 Canada vehicle production data

TABLE 198 CANADA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.4.3.2 Demand for higher fuel economy will drive the market

TABLE 199 CANADA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 200 CANADA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2027 ('000 UNITS)

TABLE 201 CANADA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 202 CANADA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4.4 MEXICO

14.4.4.1 Mexico vehicle production data

TABLE 203 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.4.4.2 Rising fuel prices, stringent emission norms will drive the market

TABLE 204 MEXICO TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 205 MEXICO TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 206 MEXICO TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 207 MEXICO TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5 ROW

14.5.1 ROW VEHICLE PRODUCTION DATA

TABLE 208 ROW: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 209 ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 210 ROW TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 ('000 UNITS)

TABLE 211 ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 212 ROW TURBOCHARGER MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.5.2 BRAZIL

14.5.2.1 Brazil vehicle production data

TABLE 213 BRAZIL: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.5.2.2 Increased sales of diesel vehicles, mild hybrid vehicles will drive the market

TABLE 214 BRAZIL TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 215 BRAZIL TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 216 BRAZIL TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 217 BRAZIL TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.3 ARGENTINA

14.5.3.1 Argentina vehicle production data

TABLE 218 ARGENTINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.5.3.2 Shift toward alternate fuels will drive the market

TABLE 219 ARGENTINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 220 ARGENTINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 221 ARGENTINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

TABLE 222 ARGENTINA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.4 IRAN

14.5.4.1 Iran vehicle production data

TABLE 223 IRAN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.5.4.2 Stringent emission norms, exploration of natural gas reserves will drive the market

TABLE 224 IRAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 225 IRAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 226 IRAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 227 IRAN TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.5 SOUTH AFRICA

14.5.5.1 South Africa vehicle production data

TABLE 228 SOUTH AFRICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.5.5.2 Increased popularity of TGDI, presence of key players will drive the market

TABLE 229 SOUTH AFRICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 230 SOUTH AFRICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 231 SOUTH AFRICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 232 SOUTH AFRICA TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.6 REST OF ROW

14.5.6.1 Rest of RoW vehicle production data

TABLE 233 OTHERS: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

14.5.6.2 Push toward cleaner transportation will drive the market

TABLE 234 REST OF ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 ('000 UNITS)

TABLE 235 REST OF ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2025 ('000 UNITS)

TABLE 236 REST OF ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 237 REST OF ROW TURBOCHARGER MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

15 RECOMMENDATIONS BY MARKETS AND MARKETS (Page No. - 182)

15.1 ASIA PACIFIC WILL BE THE MAJOR MARKET FOR AUTOMOTIVE TURBOCHARGER

15.2 ELECTRIC TURBOCHARGER CAN BE A KEY FOCUS FOR MANUFACTURERS

15.3 CONCLUSION

16 COMPETITIVE LANDSCAPE (Page No. - 183)

16.1 OVERVIEW

FIGURE 40 COMPANIES ADOPTED EXPANSIONS AS THE KEY GROWTH STRATEGY, 2017–2019

16.2 AUTOMOTIVE TURBOCHARGER MARKET: MARKET RANKING ANALYSIS

FIGURE 41 AUTOMOTIVE TURBOCHARGER MARKET: MARKET RANKING ANALYSIS, 2018

16.3 COMPETITIVE SCENARIO

TABLE 238 CONTRACTS, AGREEMENTS, AND PARTNERSHIPS, 2018–2019

16.3.1 NEW PRODUCT DEVELOPMENTS

TABLE 239 NEW PRODUCT DEVELOPMENTS, 2018–2019

16.3.2 EXPANSIONS

TABLE 240 EXPANSIONS, 2017–2019

16.3.3 COMPETITIVE LEADERSHIP MAPPING

16.3.4 VISIONARY LEADERS

16.3.5 INNOVATORS

16.3.6 DYNAMIC DIFFERENTIATORS

16.3.7 EMERGING COMPANIES

16.4 COMPETITIVE LEADERSHIP MAPPING: TURBOCHARGER MANUFACTURERS

FIGURE 42 AUTOMOTIVE TURBOCHARGER MANUFACTURERS: COMPETITIVE LEADERSHIP MAPPING, 2018

16.4.1 STRENGHT OF PRODUCT PORTFOLIO

16.4.2 BUSINESS STRATEGY EXCELLENCE

16.5 COMPETITIVE LEADERSHIP MAPPING: COMPONENT SUPPLIERS

FIGURE 43 AUTOMOTIVE TURBOCHARGER COMPONENT SUPPLIERS: COMPETITIVE LEADERSHIP MAPPING, 2018

16.5.1 STRENGTH OF PRODUCT PORTFOLIO

16.5.2 BUSINESS STRATEGY EXCELLENCE

16.6 RIGHT TO WIN

17 COMPANY PROFILES (Page No. - 197)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

17.1 KEY PLAYERS

17.1.1 HONEYWELL

FIGURE 44 HONEYWELL: COMPANY SNAPSHOT

FIGURE 45 GARRETT MOTION INC.: COMPANY SNAPSHOT

FIGURE 46 SWOT ANALYSIS: HONEYWELL

17.1.2 CONTINENTAL AG

FIGURE 47 CONTINENTAL AG: COMPANY SNAPSHOT (2018)

FIGURE 48 SWOT ANALYSIS: CONTINENTAL AG

17.1.3 BORGWARNER

FIGURE 49 BORGWARNER: COMPANY SNAPSHOT

FIGURE 50 BORGWARNER: SWOT ANALYSIS

17.1.4 MITSUBISHI HEAVY INDUSTRIES

FIGURE 51 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

FIGURE 52 MITSUBISHI HEAVY INDUSTRIES: SWOT ANALYSIS

17.1.5 IHI

FIGURE 53 IHI: COMPANY SNAPSHOT

FIGURE 54 IHI: SWOT ANALYSIS

17.1.6 BMTS TECHNOLOGY

17.1.7 CUMMINS

FIGURE 55 CUMMINS: COMPANY SNAPSHOT

17.1.8 ABB

FIGURE 56 ABB: COMPANY SNAPSHOT

17.1.9 TEL

17.1.10 DELPHI TECHNOLOGIES

FIGURE 57 DELPHI TECHNOLOGIES: COMPANY SNAPSHOT

17.2 ADDITIONAL COMPANY PROFILES

17.2.1 NORTH AMERICA

17.2.1.1 Rotomaster International

17.2.1.2 Precision Turbo & Engine Inc.

17.2.1.3 Turbonetics Inc.

17.2.1.4 Turbo International

17.2.2 EUROPE

17.2.2.1 Kompressorenbau Bannewitz GmbH

17.2.2.2 Turbo Dynamics Ltd.

17.2.2.3 Cimos

17.2.3 ASIA PACIFIC

17.2.3.1 Calsonic Kansei

17.2.3.2 Weifang FuYuan Turbocharger Co., Ltd.

17.2.3.3 Hunan Tyen Machinery Co., Ltd.

17.2.3.4 Ningbo Motor Industrial Co., Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

18 AUTOMOTIVE TURBOCHARGER ADJACENT MARKETS (Page No. - 222)

18.1 INTRODUCTION

TABLE 241 AUTOMOTIVE TURBOCHARGER ADJACENT MARKETS

18.2 LIMITATIONS

18.3 AUTOMOTIVE TURBOCHARGER ECOSYSTEM & INTERCONNECTED MARKETS

FIGURE 58 AUTOMOTIVE TURBOCHARGER ECOSYSTEM & INTERCONNECTED MARKETS

18.3.1 MARKET DEFINITION

18.3.2 LIMITATION

18.3.3 MARKET OVERVIEW

FIGURE 59 AIRCRAFT TURBOCHARGERS MARKET SIZE, BY REGION, 2018 VS 2023 (USD MILLION)

18.3.4 AIRCRAFT AND MARINE TURBOCHARGERS MARKET, BY REGION

TABLE 242 AIRCRAFT TURBOCHARGERS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 243 MARINE TURBOCHARGERS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

18.4 AUTOMOTIVE SUPERCHARGER MARKET

18.4.1 MARKET DEFINITION

18.4.2 LIMITATIONS

18.4.3 MARKET OVERVIEW

FIGURE 60 AUTOMOTIVE SUPERCHARGER MARKET, BY REGION, 2017 VS. 2025 (USD MILLION)

TABLE 244 AUTOMOTIVE SUPERCHARGER MARKET, BY REGION, 2015–2025 (THOUSAND UNITS)

TABLE 245 AUTOMOTIVE SUPERCHARGER MARKET, BY REGION, 2015–2025 (USD MILLION)

18.5 GDI SYSTEM MARKET

18.5.1 MARKET DEFINITION

18.5.2 LIMITATIONS

18.5.3 MARKET OVERVIEW

18.5.4 GDI SYSTEM MARKET

FIGURE 61 GDI SYSTEM MARKET, BY REGION, 2017 VS. 2025 (USD MILLION)

TABLE 246 GDI SYSTEM MARKET, BY REGION, 2015–2025 ('OOO UNITS)

TABLE 247 GDI SYSTEM MARKET, BY REGION, 2015–2025 (USD MILLION)

18.6 EXHAUST HEAT RECOVERY SYSTEM MARKET

18.6.1 MARKET DEFINITION

18.6.2 LIMITATIONS

18.6.3 MARKET OVERVIEW

FIGURE 62 EXHAUST HEAT RECOVERY SYSTEM MARKET, BY TECHNOLOGY, 2018 VS. 2025 (USD BILLION)

TABLE 248 EXHAUST HEAT RECOVERY SYSTEM MARKET, BY TECHNOLOGY, 2016–2025 (MILLION UNITS)

TABLE 249 EXHAUST HEAT RECOVERY SYSTEM MARKET, BY TECHNOLOGY, 2016–2025 (USD BILLION)

19 APPENDIX (Page No. - 234)

19.1 INSIGHTS OF INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.4 AVAILABLE CUSTOMIZATIONS

19.4.1 AUTOMOTIVE TURBOCHARGER MARKET, BY TECHNOLOGY

19.4.1.1 VGT/VNT Market, By Country Mining

19.4.1.2 Wastegate Turbocharger, By Country

19.4.1.3 Electric Turbocharger Market, By Country

19.4.2 VEHICLE TYPE-WISE TURBOCHARGER TECHNOLOGY ANALYSIS

19.4.3 LOCOMOTIVE TURBOCHARGER MARKET, BY REGION

19.4.3.1 Asia Pacific

19.4.3.2 Europe

19.4.3.3 North America

19.4.3.4 RoW

19.4.4 MARINE TURBOCHARGERS MARKET, BY REGION

19.4.4.1 Asia Pacific

19.4.4.2 Europe

19.4.4.3 North America

19.4.4.4 RoW

19.4.5 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

The study involved four main activities in estimating the current size of the automotive turbocharger market. Exhaustive secondary research was done to collect information about the Automotive Turbocharger Market, By Technology, Material, On- & Off-Highway Vehicles, Fuel Type, Components, and Region. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. A mix of top-down and bottom-up approach was employed to estimate the overall market size for different segments considered in this study.

The secondary sources referred for this research study include automotive industry organizations such as International council on clean transportation (ICCT); Organisation Internationale des Constructeurs d'Automobiles (OICA); European Automobile Manufacturers Association (ACEA); The Construction Equipment Association (CEA); Automotive Components manufacturers Association, International Energy Agency (IEA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and regional component-related associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Extensive primary research has been conducted after acquiring an understanding of the automotive turbocharger market scenario through secondary research. Several primary interviews were conducted with industry experts from both the demand- (OEMs and engine manufacturers) and the supply-side (turbocharger manufacturers, material suppliers) across four major regions, namely, Asia Oceania, Europe, North America, and the Rest of the World (RoW). Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the results as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

The bottom-up approach has been used to estimate and validate the size of the turbocharger market. In this approach, the vehicle production statistics for each vehicle type (passenger car, LCV, and HCV) at a country and regional level respectively have been considered. The country-level penetration rate of turbochargers in gasoline and diesel is derived through country-wise model mapping of vehicle types, and the same validated through primary respondents. This gives country-level gasoline and diesel turbochargers market by vehicle type.

Further, it is segmented at the regional level in terms of turbocharger type (wastegate, VGT/VNT, and electric turbocharger). To determine the market size, in terms of value, the country-level market size for the automotive turbocharger is multiplied by the regional average selling price of each turbocharger type. The summation of the country-level market gives the regional market, and further summation of the local market provides the global on-highway turbocharger market. A similar methodology has been followed to estimate the automotive turbocharger market for off-highway vehicles (construction, mining equipment, and agriculture tractors) and electric vehicles (BEV, HEV, and PHEV).

To know about the assumptions considered for the study, Request for Free Sample Report

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

To define, describe, and forecast the Global Automotive turbocharger market, in terms of value (USD million)

To define, describe Automotive Turbocharger Market, by value and volume, based on turbocharger technology (VGT, wastegate, electric) at the regional level

To define, describe Automotive Turbocharger Market in terms of value and volume, based on the material (cast iron, aluminum & others) at the regional level.

To define, describe Automotive Turbocharger Market, in terms of value and volume, based on fuel type (gasoline, diesel, and CNG/alternate fuel) at the regional level

To define, describe, and forecast the turbocharger market, by value and volume, based on On-Highway Vehicle Type (passenger cars, light commercial vehicles, trucks, and buses) and Off-Highway Vehicles (agriculture, construction) at the regional level

To define, describe, and forecast the turbocharger aftermarket, by value and volume, at the regional level

To define, describe, and forecast the Global Automotive turbocharger market, by value, based on region (Asia Oceania, Europe, North America, and RoW)

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of Global Automotive turbocharger market

To analyze the market share of the key players operating in the Global Automotive turbocharger market

To examine recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the Global Automotive turbocharger market.

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Global Automotive Turbocharger Market, By Technology

VGT / VNT市场,按国家

废气门涡轮增压器,按国家

电动涡轮增压器市场,按国家

整车式涡轮增压器技术分析

机车涡轮增压器市场,按地区

亚洲大洋洲

欧洲

北美

行

各地区船用涡轮增压器市场

亚洲大洋洲

欧洲

北美

联系客服